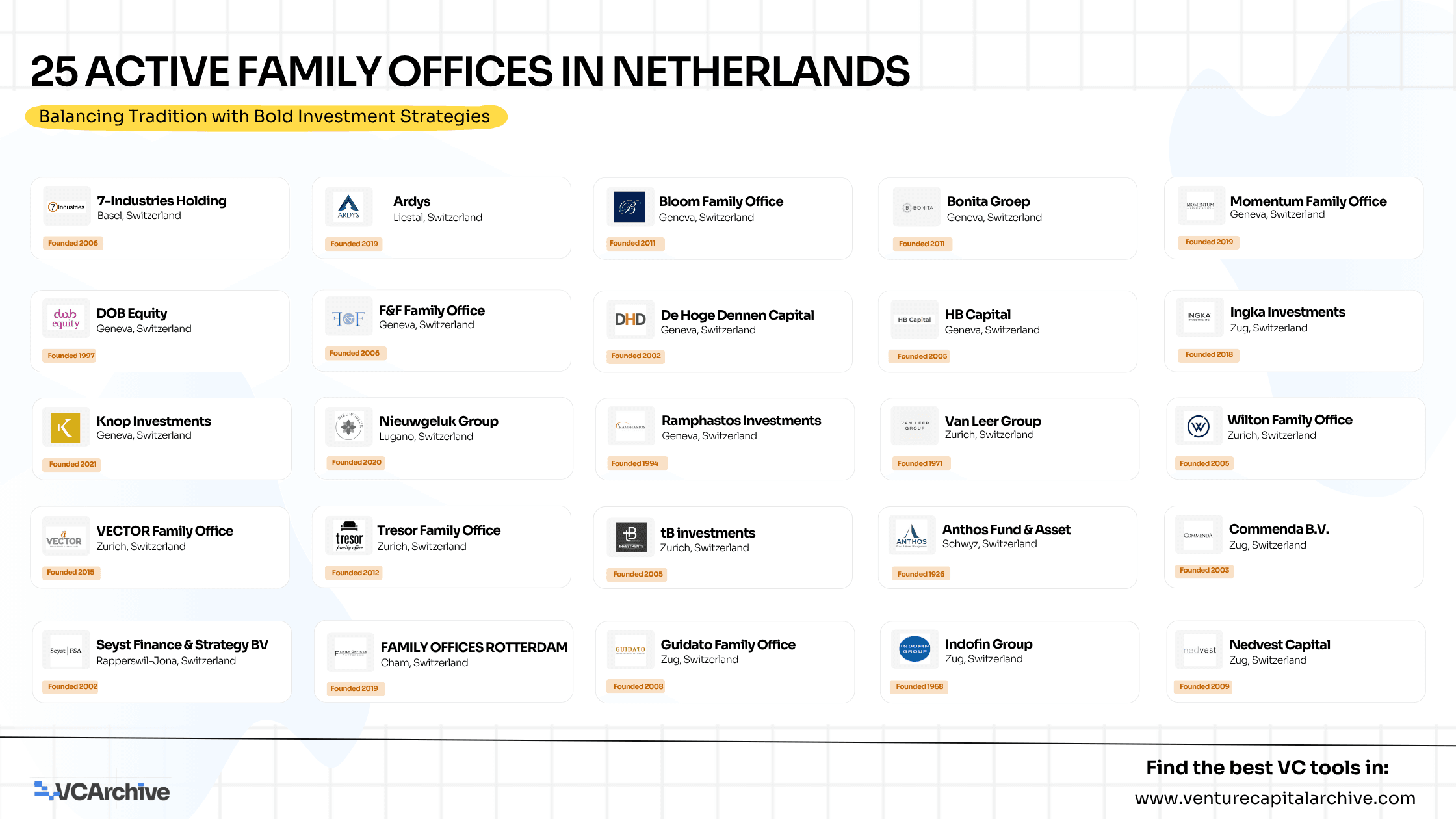

25 Active Family Offices in Netherlands

This list will dive into 25 active family offices that are shaping the future of wealth in the Netherlands. These firms offer a combination of patient capital, strategic support, and entrepreneurial mentorship, all while focusing on long-term value creation.

Spotlight on Key Dutch Family Offices

1. 7-Industries Holding (Amstelveen)

A diversified investment firm targeting industries like life sciences, technology, and sustainability. With an emphasis on long-term growth, 7-Industries takes minority stakes and provides strategic expertise to help companies thrive.

Portfolio: SECO S.p.A, Welltec.

2. Ardys (Amsterdam)

A multi-family office with a focus on innovative, sustainable investments in sectors like real estate and fintech. Ardys combines wealth management with entrepreneurial support, seeking to build value across industries.

Expertise: Strategic investments, operational assistance.

3. Bloom Family Office (Heusden)

Specializing in wealth preservation and impact investing, Bloom supports its clients with personalized financial planning and investment opportunities across sectors like healthcare, technology, and consumer internet.

Portfolio: Not specified.

4. Bonita Groep (Oisterwijk)

A family office with deep ties in real estate and hospitality, focusing on sustainable investments in the Netherlands and Europe. Bonita supports businesses with strong fundamentals and long-term potential.

Portfolio: Copal Handling Systems, Webpower, FLM Foodingredients.

5. Momentum Family Office (Amsterdam)

Focused on impact investing and sustainability, Momentum invests across multiple sectors, with a special focus on Africa. The firm employs a diversified approach, ranging from private equity to real assets.

Portfolio: 365 Capital, Acrobator, Alpinvest IBS, and more.

6. DOB Equity (Amsterdam)

An impact-focused firm that partners with East African entrepreneurs to drive economic development. With investments ranging from $500K to $5M, DOB focuses on food security, education, and healthcare.

Portfolio: M-KOPA, Twiga Foods, Sendy.

7. F&F Family Office (Nieuwkuijk)

This office focuses on wealth preservation and long-term value creation through direct investments in equities, private equity, and real estate. F&F works with high-net-worth families to ensure sustainable growth across generations.

Portfolio: Not specified.

8. De Hoge Dennen Capital (Laren)

Specializing in private equity, real estate, and fund management, De Hoge Dennen invests in mid-sized companies, particularly in the Dutch market, with a long-term strategy of active ownership.

Portfolio: RetourMatras, Morssinkhof Rymoplast.

9. HB Capital (Laren)

An investment firm focusing on real estate, private equity, and capital markets. With a long-term approach, HB Capital has investments across various sectors, including commercial and residential properties.

Portfolio: Not specified.

10. Ingka Investments (Leiden)

The investment arm of IKEA, Ingka focuses on forestland, renewable energy, and real estate, balancing financial returns with sustainability.

Portfolio: Winnow.

These offices are not just capital providers, they’re value creators who work closely with entrepreneurs to scale businesses across technology, impact investing, and real estate development. Many of these family offices, such as 7-Industries Holding, Ardys, and Momentum Family Office, also provide strategic advisory and hands-on operational support to the companies they invest in.

Key Takeaways:

- Sustainability is at the core of many Dutch family offices, with significant investments in green technologies, impact-driven ventures, and ethical investing.

- These family offices tend to be patient capital providers, focusing on long-term growth rather than quick exits.

- Impact investing is a recurring theme, with firms like DOB Equity and Bloom Family Office emphasizing social responsibility and community development in their portfolios.

The Netherlands' Rising Influence in Global Family Office Networks

As the family office landscape continues to evolve, Dutch family offices are rapidly gaining recognition for their global reach and impact-driven investments. Many of these offices operate not only in the Netherlands but also in key markets like the United States, China, and India, making them influential players in the global wealth management space.

For anyone looking to tap into the growing trend of patient capital and strategic investments, the Dutch family office network offers a range of opportunities, from early-stage startups to established enterprises.

Discover More

Explore full list on 25 active family offices shaping the future of wealth management in the Netherlands, and check out our detailed database and investment insights on VCArchive.

25 Active Family Offices in Netherlands